Technology has increased access to information, making the world more similar on a macro and sub-macro level. However, despite the increased similarity, research shows business models are rarely horizontal, emphasizing the importance of micro-level strategic consideration. Companies routinely enter new markets relying on knowledge of how their industry works and the competencies that led to success in their home markets while not being cognizant of granular details that can make the difference between success and failure in a new market. Only through machine-driven intelligence can companies address the level of detail needed in a scalable and fast manner to remain competitive.

Furthermore, machine intelligence and information have led to the rapidly diminishing value of expertise and eroding the value of information. The expertise needed to outrun or beat machine intelligence has exponentially increased yearly. Over the next one to two years, the most successful companies will accept the burden of proof that they have switched from technologies and AI to human expertise. Furthermore, machines will come to reframe what business and strategy mean. Business expertise in the future will be the ability to synthesize and explore data sets and create options using augmented intelligence – not being an expert on a subject per se. The game changers will have the fastest “information to action” at scale.

A residual of that characteristic makes a “good” or “ok” decision’s value exponentially highest at the beginning – and oftentimes much more valuable than a perfect decision. To address this trend, organizations must focus on developing processes and internal communication that foster faster “information-to-action” opportunity cost transaction times, similar to how traders look at financial markets. Those margins of competitive edge will continue to shrink but will become exponentially more valuable.

Why businesses harnessing AI and other technologies are leading the way

Studies show experts consistently fail at forecasting and traditionally perform worse than random guessing in businesses as diverse as medicine, real estate valuation, and political elections. This is because people traditionally weigh experiences and information in very biased ways. In the knowledge economy, this is detrimental to strategy and business decisions.

Working with machines enables businesses to learn and quantify connections and influence in ways humans cannot. An issue is rarely isolated to the confines of a specific domain, and part of Walmart’s analytics strategy is to focus on key variables in the context of other variables that are connected. This can be done in extremely high resolution by taking a machine-based approach to mining disparate data sets, ultimately allowing flexibility and higher-resolution KPIs to make business decisions.

The effects of digital disintermediation and the sharing economy on productivity growth

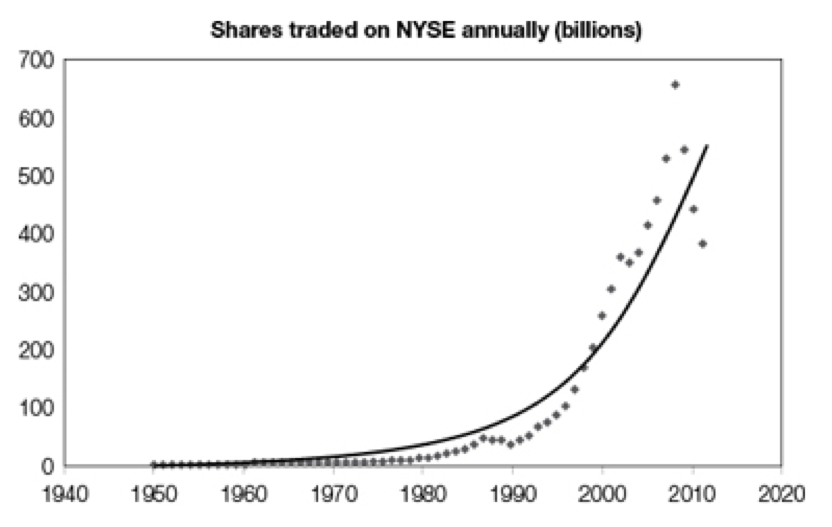

Machines have increased humans’ ability to synthesize multiple information streams simultaneously, as well as our ability to communicate these insights, which should lead to a higher utility on assets. In the future, businesses will likely have to be more focused on opportunity cost and re-imagine asset allocation with increased competition due to lower barriers to entry. Inherently, intelligence and insights are about decisions. A residual of that characteristic makes a good or ok decision’s value exponentially highest in the beginning – and oftentimes more valuable than a perfect decision. To address this trend, organizations must focus on developing processes and internal communication that foster faster “information-to-action” transaction times, much like how traders look at financial markets.

Is this the beginning of the end?

Frameworks driven by machines will allow humans to focus on more meaningful and creative strategies that cut through the noise to find what variables can be controlled, mitigating superficial processes and problems. As a result, it is the end for people and companies that rely on information and routine for work. And the beginning for those who can solve abstract problems with creative and unorthodox thinking within tight margins. Those who do so will also be able to scale those skills globally with advancements in communication technology and the sharing economy, which will considerably speed up liquidity on hard and knowledge-based assets.